Business Insurance Services Provider Based in Hazelwood Park

Ginn & Penny, based in Hazelwood Park, SA, is a top-tier insurance provider, and we can offer comprehensive business insurance packages. Whether you’re after farm insurance, construction insurance or something else, we’ve got you covered. Contact us today for a conversation about how we can help you!

Business Insurance

Enjoy the security of an established, financially sound insurance company. Your business is your livelihood and it is important to protect it wisely. Ginn & Penny can provide insurance protection for retail, offices, commercial and industrial businesses, and trades. Our insurance products are carefully selected from the major insurance companies. Business insurance is designed to protect your business against a range of contingencies including, fire, burglary, accidental damage, public & product liability, professional indemnity and business interruption. Contact us today to find out how a comprehensive Business Insurance Package Ginn & Penny can help you.

Slide title

Write your caption hereButton

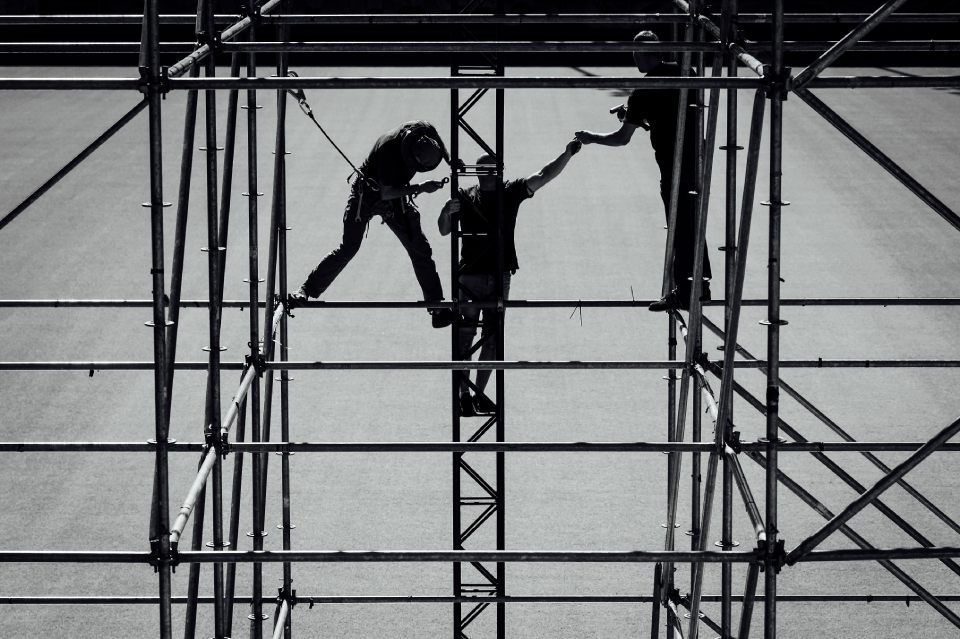

Construction Insurance

We have specialist expertise in providing insurance solutions to the construction and engineering sector, offering you comprehensive financial protection against many areas of risk, including construction material damage, construction liability and machinery and plant equipment failure.

Our flexible approach means we can tailor our policies to suit specific needs and cater for projects of all sizes, from owner builders through to the principals of major engineering infrastructure projects.

Farm Insurance

We are committed to providing our customers with quality advice and service based on their needs, goals and current situations.

We understand that, in farming, your business is your livelihood, so you can't afford to take chances with either your farm insurance or your home and contents insurance cover.

Slide title

Write your caption hereButton

-

More Info for Farmers

We will help you to tailor a policy from a range of cover options to suit your particular farm insurance needs. You can select specific covers from farm machinery insurance, building insurance, home and contents insurance as well as crop, fence, livestock and power pole insurance.

Farm insurance offers flexible cover that can be tailored to suit your needs and protect your farm against a range of contingencies such as:

• farm liability

• farm property

• home & contents

• personal effects

• domestic legal liability

• motor vehicle

• additional working costs

• equipment breakdown

• road transit

• tax audit

Some policies require you to take out a minimum number of covers under the policy.

More Insurance Services

-

Goods in Transit (Marine Cargo)

Let us help you keep your cargo on the move. We offer solutions for transits within Australia, to and from Australia or worldwide to worldwide.

Conventional cargo cover includes:

• combined cargo (import/export and within Australia)

• annual import/export, and

• single transit covers

Our insurers also produce specific wordings for specialised cargo, such as:

• fruit and vegetables

• bulk commodities

• livestock, and

• cargo loss of profits

-

IT Liability Insurance

This policy gives you protection against legal liability arising from the failure of products, services and/or advice. The information technology industry has unique liability exposures due to the crossover between the provision of professional services and supply of goods with many service providers in this industry having a mix of both. This is further complicated by the legal ambiguity surrounding software advice and development and whether it is in fact the provision of a service or the sale of goods. We have access to a range of insurance products that are commonly referred to as IT Liability policies. These policies represent a combination of Professional Indemnity and Public and Products Liability insurances within the one product with a view to minimising the prospect of an uninsured claim due to it “falling between the gaps” between the two traditional insurance products.

-

Management Liability Insurance

Management Liability Insurance Policy features coverage and benefits to address the serious risks confronting private companies and their management teams. This policy is divided into seven modules that include six coverage sections each with their own limit, subject to a policy maximum limit of liability.

• Directors and Officers Liability

• Corporate Legal Liability (entity cover)

• Statutory Liability

• Employment Practices Liability

• Employee Dishonesty

• Kidnap & Extortion

-

Professional Indemnity Insurance

Professional Indemnity Insurance, also referred to as PI Insurance, provides financial protection for companies and individuals for claims made against them in the course of carrying out their professional services.

No matter how capable or experienced you are, or how good your intentions, mistakes can and do happen. Claims are a fact of life these days and can financially cripple you and your business.

PI Insurance must be in place at the time a claim is made against you and is therefore described as a "claims-made" policy. This means that the policy only provides cover for claims made against you during the period of insurance and subject to the terms and conditions (including exclusions) of the policy in place at that time.

PI claims can be made against you by clients, regulatory authorities, professional bodies & associations, as well as other third parties to whom you owe a duty of care (including communities).

-

Public & Products Liability Insurance

We can source a policy that covers your legal liability to pay compensation for personal injury or damage to property happening during the period of insurance and caused by an occurrence connected with your business; includes reasonable legal costs of investigating and defending claims against you.

-

Commercial Motor Vehicle Insurance

Commercial motor vehicle insurance covers a full range of events from accidental loss or damage, fire, theft or attempted theft, malicious damage or storm damage to your business vehicles.

Commercial motor vehicle insurance offers you competitive motor insurance rates. If you are looking for comprehensive commercial motor insurance cover for your car, 4WD, utility, van, prime mover, or trucks over 2 tonnes, we can tailor a policy to suit your needs.

So when you talk to us, you can relax and feel confident knowing you have the right insurance for your business.

We can arrange two types of commercial motor vehicle insurance cover:

• Comprehensive cover (Theft or damage & legal liability)

• Legal liability cover (Third party only)